Local TV station owner Tegna announced this morning that it is selling to private owner Standard General for $5.4 billion ($24 per share) plus the assumption of debt, which makes the total value of the sale around $8.6 billion.

It ends the battle for control of the company that began after Standard General became the largest holder of Tegna stock and Standard General head Soo Kim attempted to gain seats on the Tegna board.

Kim had been critical of Tegna’s leadership, even while attempting to buy the company. At one point, Kim accused the head of Tegna of being racially insensitive and called for an investigation. He sought to unseat three Tegna board members following that dispute. Kim also was publicly critical of Tegna giving CEO Dave Lougee a 16% pay raise — raising his base compensation to $6.7 million — while the company’s stock prices dropped and Tegna furloughed and cut pay for employees.

Still, the sides came together to complete a sale.

That nasty proxy fight between Kim and Tegna provides some hints about how Standard General might run the Tegna stations.

For months, Standard General pounded away at Tegna’s performance compared to other broadcast groups in an attempt to unseat three Tegna board members and replace them with Standard’s picks. In April 2020, Standard General issued a detailed attack on Tegna’s profitability that included a reference that worried Tegna employees. It posted this graphic, in which it said Tegna stations have “2x the number of employees per station compared to peers” but lags behind its peers in profitability.”

The attack did not say that Standard General believed Tegna should cut staff, but it has to be unsettling for employees to know that their new station owner once stated that Tegna stations had two times more employees than their peers and that might bear on their profitability. In every takeover, the first fear is that the new owner will come in and slash jobs.

Tegna responded with a “fact sheet” of its own, saying, “Standard General cites an irrelevant metric of TEGNA’s employees per station. What is relevant is that TEGNA has the highest EBITDA per employee – more than $137,000 – in comparison to peers Nexstar and Gray, both less than $115,000.”

Tegna owns 64 local TV stations in 51 markets and is the largest independent owner of NBC affiliates.

A map of Tegna’s TV markets (Screenshot/Tegna)

The sale brings a couple of ownership stories full circle. Tegna, which owns legacy TV stations in key growth cities including Atlanta, Denver, Dallas, Seattle, Washington, D.C., Tampa, Charlotte and Minneapolis, was the spin-off company that formed when Gannett split its print and broadcast divisions.

Standard General intends to sell some of Tegna’s stations to the Cox Media Group, which is owned by Apollo Global Management. Cox told its local stations Tuesday morning that the plan is for Standard General to sell Tegna’s Texas TV station group to Apollo.

Cox describes the acquisition as a four-step process:

- First, CMG will acquire the station group currently owned by Standard General’s affiliate, Community News Media LLC (CNM).

- In a second, subsequent transaction, a Standard General affiliate will acquire CMG’s WFXT/Boston as the anchor of a new station group.

- Following the close of those two transactions, the Standard General affiliate will acquire TEGNA, in a take-private deal that Standard General and TEGNA separately announced today.

- In a subsequent transaction that would follow the Standard General affiliate’s acquisition of TEGNA, CMG will acquire TEGNA’s Austin, Texas station, KVUE-TV, its Dallas stations, WFAA and KMPX, and its Houston stations, KHOU and KTBU.

Cox currently operates 33 local broadcast stations in 33 markets.

Standard General was formed in 2007 to manage pension funds and endowments. The company says it is “a minority-controlled and operated organization” and, once the Tegna sale is complete, the new company will be the “nation’s largest minority-owned, woman-led broadcast group.”Standard General describes itself as an investor looking for companies undergoing “dramatic change.” The broadcasting industry is without a doubt facing change in the ways it reaches audiences.

Standard General is known for investing in distressed indebted companies. In the early days of the company, for example, it attempted to revive Radio Shack. It previously rescued Young Broadcasting from bankruptcy and then became the largest shareholder of Media General. Media General merged with LIN Media and became the fifth-largest owner of local TV stations in the United States. Then Media General sold to Nexstar in 2017. Deb McDermott, the head of Young who became the head of Media General, went on to run Standard General’s media group. Now, McDermott will be the CEO of the new station group that will include the former Tegna stations.

Standard General is the largest shareholder in Bally’s, a casino company. Even as COVID-19 spelled difficult times for casinos, Bally’s bought three additional properties during the pandemic. In July 2020, Kim said, “A lot of casino companies, due to their balance sheets going up too high, are in tough shape now and are not prepared to take advantage of this regional opportunity.”

Standard General also has a partnership with mega-TV station owner Sinclair Broadcast Group. Sinclair agreed to rename the 21 Fox Regional Sports Networks to Bally Sports Regional Networks in an $85 million deal in 2020. Kim said then that he envisioned the Ballys/Sinclair partnership as “an opportunity to revolutionize the U.S. sports betting, gaming and media industries.” He wants Ballys to be involved in “sports betting and iGaming offerings to customers on a national scale.” And he envisioned the deal with Sinclair as a step toward that, saying, “Sinclair, with its broad holdings of stations, channels and RSNs, provides immediate, national brand recognition that will support the development of Bally’s player database for both our traditional casinos as well as our future online offerings, and ultimately deliver significant shareholder value.”

It is unknown how the purchase of Tegna would add to that plan to increase sports betting.

Standard General’s self-description includes hints about how it might operate TV stations:

We focus on companies with complex capital structures that are undergoing dramatic change or are faced with material events.

The key to our investment approach is familiarity with both credit markets and equity investing. Companies in our universe have investable equity and credit components. Our experienced investment professionals analyze how each part of a company’s capital structure will act and interact with the whole.

We complement this analysis with an event-driven approach. We seek mispriced opportunities that we anticipate the market will correct, or where we ourselves have the opportunity to create value. We apply this framework in an even-handed manner that generates both long and short investment ideas. Combining a catalyst-dependent focus with our willingness to position ourselves flexibly allows us to target an all-weather stream of returns. We believe this approach can generate a differentiated and uncorrelated return stream.

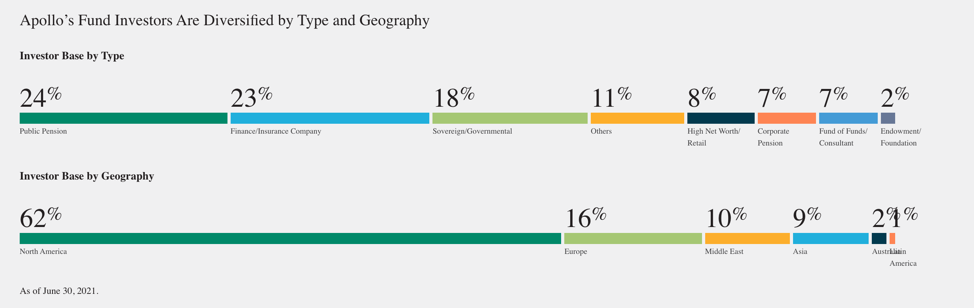

We primarily manage capital for public and private pension plans, endowments, foundations, and high net worth individuals.

Apollo is an asset management company with $498 billion in assets. It calls itself “a high-growth alternative asset manager.” Apollo makes a strong statement about its commitment to equality on its website’s front page: “We are proud that Apollo has achieved 100% on the Human Rights Campaign Foundation’s 2022 Corporate Equality Index (CEI) and named one of the “Best Places to Work for LGBTQ Equality” for the second year in a row.”

Apollo also says it is significantly invested in clean energy: “We take a patient, creative and rigorous approach to investing.” It is an important statement in a media world not known for patience in investing.

It is interesting to see who invests in Apollo. This is their chart. Notice the biggest investors are pension funds and finance and insurance companies. 40% of the investors are not in the United States.

(Apollo)

The whole deal, of course, will come under Federal Communications Commission examination because it will involve Cox and Standard General owning key stations in major markets, including Seattle and Atlanta. We will have to see if the FCC shows any concern for the fact that Standard, Apollo and Cox will all be intertwined. The joint announcement on the sale of the Tegna stations described how the media company will be governed, with Standard General making all of the decisions but using money from Apollo underneath it all, though Apollo won’t have controlling votes:

An affiliate of Standard General will hold substantially all of the voting, common equity in the new entity that is acquiring Tegna, with CMG and funds managed by affiliates of Apollo Global Management to hold securities in the new entity that will be non-voting and non-attributable and with other investors holding non-voting interests.

There will be some urgency to get the deal closed since local TV stations expect to cash in on contentious midterm elections across the country. Standard says it expects to close the transactions in the second half of the year.

This article has been updated.