Covering COVID-19 is a daily Poynter briefing of story ideas about the coronavirus for journalists, written by senior faculty Al Tompkins. Sign up here to have it delivered to your inbox every weekday morning.

Covering COVID-19 is a daily Poynter briefing of story ideas about the coronavirus for journalists, written by senior faculty Al Tompkins. Sign up here to have it delivered to your inbox every weekday morning.

Let’s address the stigma of food stamps

A lot of people are out of work who have never had to lean on government assistance before. With the unemployment figures coming out Friday, this story takes on a new urgency.

While we are talking about the need for food assistance, let’s spend a few moments to recognize that food stamps carry an unfortunate and unwarranted stigma. The whole notion that you can use food stamps to live on filet mignon is a tired trope perhaps perpetuated by people who have never had to stretch the national average of $1.30 per person per meal, which is what food stamps will buy you.

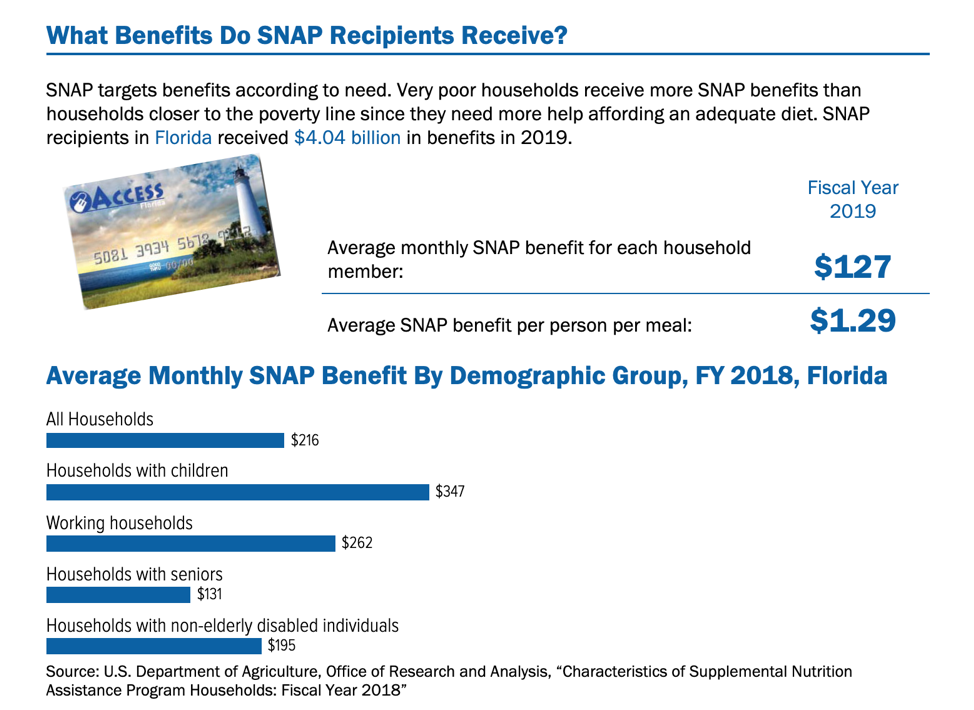

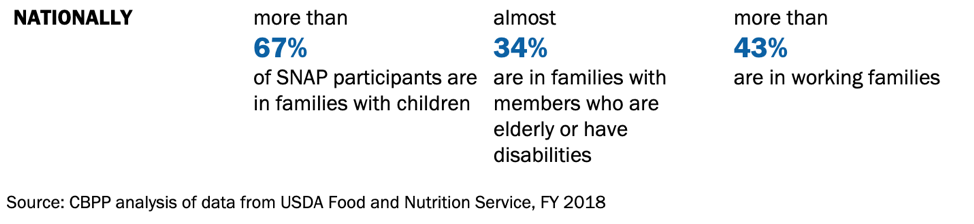

Data from the Center on Budget and Policy Priorities shows just how much help Florida’s Supplemental Nutrition Assistance Program provides recipients:

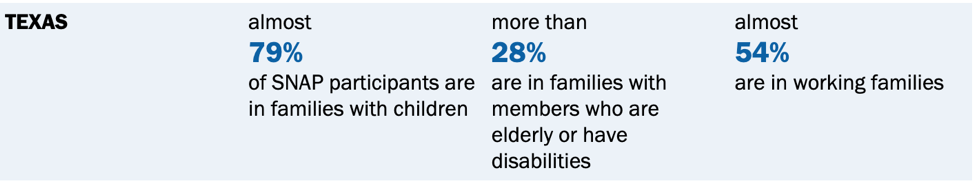

You can go here to see state-by-state data on who uses food stamps. The demographics may surprise you.

You can go here to see state-by-state data on who uses food stamps. The demographics may surprise you.

In Minnesota and Texas, for example, more than half of households using SNAP benefits are “working families.”

In Minnesota and Texas, for example, more than half of households using SNAP benefits are “working families.”

Journalists, this is a time when you can put a face on this stigma. You can point out that while they were working, they paid into the system that they now need to lean on. It is not very different from drawing unemployment benefits, which we taxpayers and our employers also fund.

I read this post from BuzzFeed’s Janelle Harris two years ago and it stuck with me. It’s a story about the shame and fear Harris felt the first time she used her benefits card. If you qualify for food stamps right now, you should know that there’s no shame in ensuring you can feed yourself and your family.

What about food stamp fraud?

Yes, it happens, but not as often as you might believe. The most common fraud involves selling SNAP cards for cash and fraud on the retailer side.

Department of Agriculture assistant inspector general Ann Coffey told a congressional subcommittee last year that her office had recovered $463 million in improper SNAP payments in the last five years. Those federal investigations resulted in 2,335 criminal convictions, she said. By way of background, the feds generally go after retailers because that is who the government pays, while states go after individuals, because that is who the states send benefits to. To get an accurate picture of prosecutions, you will need to look both places.

Food stamps take on a new importance

COVID-19 has forced governments to make some changes they probably should have done a long time ago. For example, in about a dozen states now, food stamp recipients can use their benefits to buy food online. Congress authorized a pilot program six years ago as part of the 2014 Farm Bill, but the pandemic has created a much higher need and kicked it into a higher gear.

NPR pointed out that the ability to use food stamps online matters because so many people on the program also are at risk for the virus. NPR said:

There are a series of technology hurdles — from stores needing new systems online that differentiate between food and non-food items to states needing new systems to handle new payment processors. They’re not unsolvable problems, they just haven’t been done; food stamp issues don’t tend to be top-of-mind for most technologists.

Because of COVID-19, the USDA now says it’ll fast-track any state that wants to join the pilot. Eleven more were just approved, including California. Many should be online with authorized retailers by some point in May. In those states, Walmart will accept SNAP for grocery pickup but not delivery (and did not respond to NPR’s requests for explanation); Amazon and Amazon Fresh will accept SNAP for online grocery orders, but SNAP customers of Amazon’s Whole Foods chain will still have to shop in person.

So, even where delivery is possible, options are limited, and for the majority of SNAP recipients, still not possible.

Walmart and some others have figured out a workaround. They allow food stamp recipients to order online, then use SNAP benefits cards when they pick up their orders. That still requires buyers to leave their homes.

The New York Times said Walmart and Amazon are now set up in nine states to allow food stamp users to buy and pay online: New York, the first to join a year ago; Washington; Alabama; Iowa; Oregon; Nebraska; Florida; and Kentucky and California, both of which started this month. The Times Added:

The District of Columbia and several states — Arizona, Idaho, North Carolina, West Virginia, Missouri, Texas and Vermont — have signed up over the last month but are not yet up and running. Once they are, the pilot program will cover more than half the country’s SNAP participants, according to the Agriculture Department.

Whether your state is part of the program, about to be or still isn’t, there is a story in there for you to help your readers/listeners/viewers get the benefits they are qualified for (and paid for through taxes all their working years).

This website built a collection of grocery stores that accept food stamps and do deliver. The government does not consider Instacart, which gives shoppers access to delivery from 52,000 stores, to be a retailer. So a shopper using SNAP benefits cannot use Instacart.

The Brookings Institute published some disturbing new data that shows the urgency of food assistance right now (note, this is NEW data).

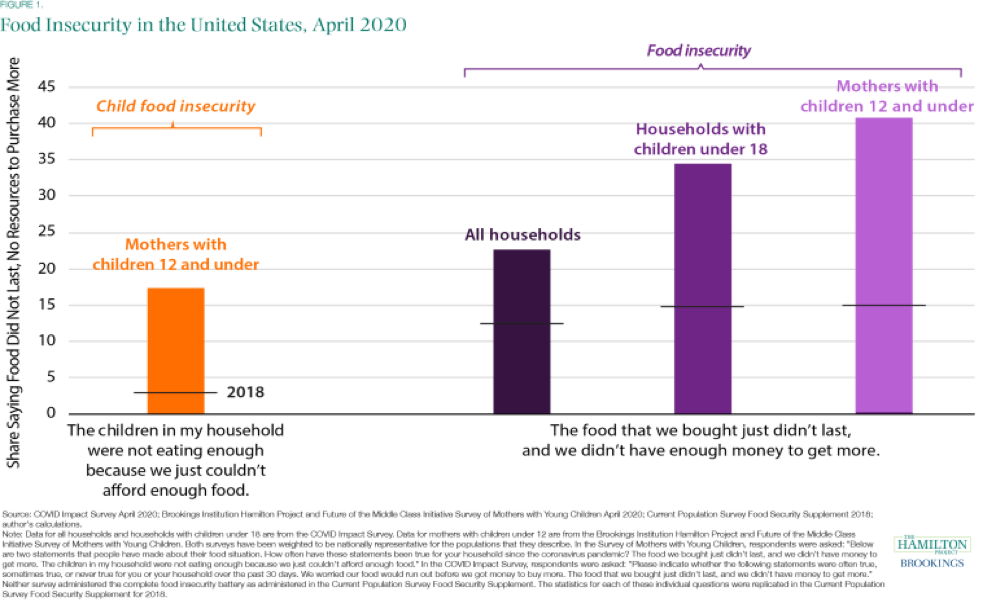

By the end of April, more than one in five households in the United States, and two in five households with mothers with children 12 and under, were food insecure. In almost one in five households of mothers with children age 12 and under, the children were experiencing food insecurity.

See the black, horizontal lines on each vertical bar? That is what their 2018 study showed.

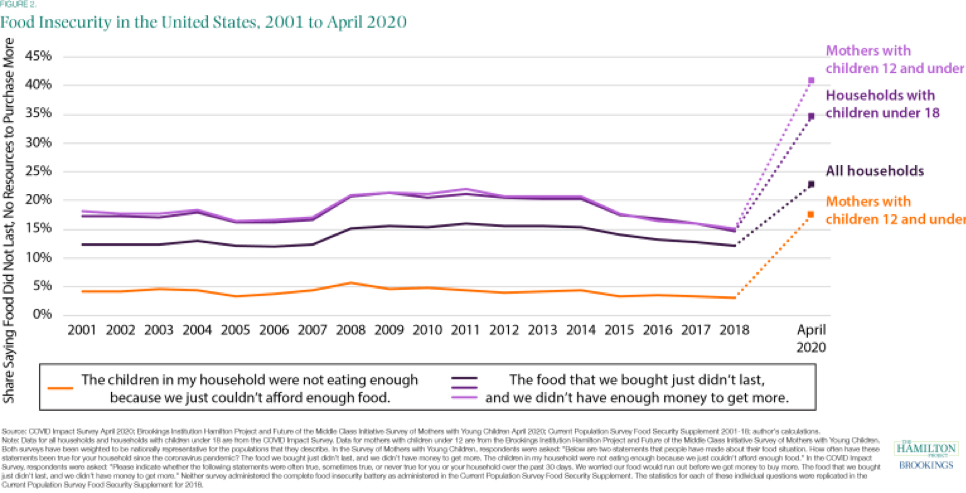

Put some context around these figures. Brookings has gathered data on this issue since 2001 and no year comes close to what we are seeing now. Brookings said, “it is clear that young children are experiencing food insecurity to an extent unprecedented in modern times.”

Put some context around these figures. Brookings has gathered data on this issue since 2001 and no year comes close to what we are seeing now. Brookings said, “it is clear that young children are experiencing food insecurity to an extent unprecedented in modern times.”

The study concluded that Congress should increase SNAP benefits by at least 15% and also increase the minimum allotments. Food stamps have been a target of the Trump administration. As the pandemic was unfolding a month ago, the president planned to impose stricter work requirements on 700,000 adults without children who receive SNAP benefits. But by mid-April, the administration had delayed the new regulations.

The study concluded that Congress should increase SNAP benefits by at least 15% and also increase the minimum allotments. Food stamps have been a target of the Trump administration. As the pandemic was unfolding a month ago, the president planned to impose stricter work requirements on 700,000 adults without children who receive SNAP benefits. But by mid-April, the administration had delayed the new regulations.

Unemployment’s toll on mental health

Don’t think of Friday’s unemployment figures as statistics. Think of them as people who don’t know how they are going to pay their next electricity and water bills. Think of them as people who have not just lost their jobs, but also their health insurance — the safety net beneath their families.

President Donald Trump recently said if people lose their jobs and if the economy does not reopen soon, “You’re going to have mental depression for people. You’re going to have large numbers of suicides. Take a look at what happens in a really horrible recession or worse. So, you’re going to have tremendous suicides.”

If the president is right — and a chorus of experts have shared similar sentiments — we will soon be seeing a new pressure. The moment people lose their insurance that pays for mental health care is the moment they need it most. The recently passed CARES Act included $425 million for mental health services and the regulatory flexibility that increases access to telehealth, but community health clinics are already overrun. How will we supply the mental health care the president predicts we’ll need?

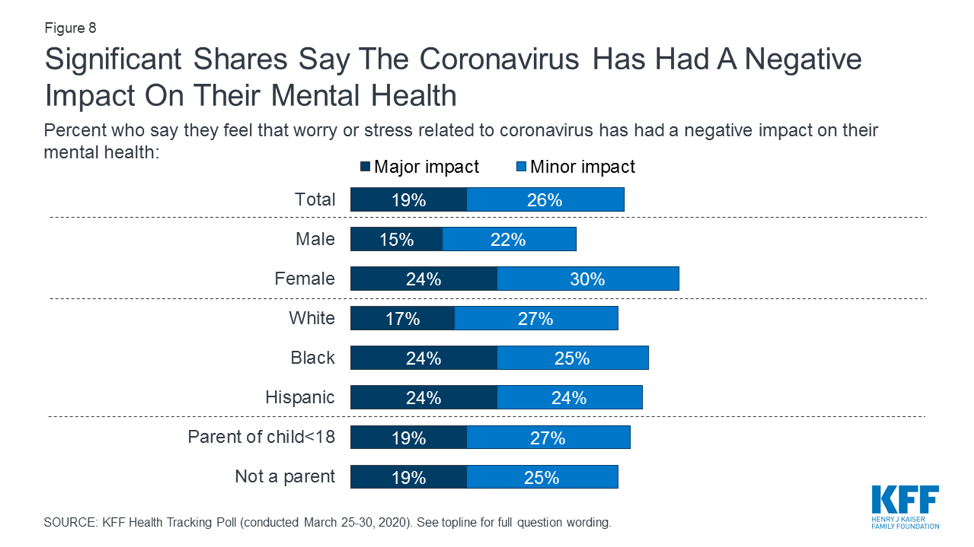

The Kaiser Family Foundation’s polling found nearly half of Americans reported the pandemic has had a negative impact on their mental health.

Kristen Choi, a trauma expert at the UCLA School of Nursing, said, “This pandemic has potential to harm mental health in communities, and over time, the need for mental health services may increase. Mental disorders like depression, anxiety, PTSD, self-harm, and others could become a ‘second pandemic.’ We need to be anticipating needs, preparing resources, and developing adaptive care delivery models now,”

Kristen Choi, a trauma expert at the UCLA School of Nursing, said, “This pandemic has potential to harm mental health in communities, and over time, the need for mental health services may increase. Mental disorders like depression, anxiety, PTSD, self-harm, and others could become a ‘second pandemic.’ We need to be anticipating needs, preparing resources, and developing adaptive care delivery models now,”

The American Psychological Association said a free Coursera course in Psychological First Aid developed by psychologist George Everly Jr., a professor at the Center for Public Health Preparedness at Johns Hopkins University, usually sees about 300 to 400 students per week. In the first week of April, 11,000 people took the class. Now, more than two million people in total have taken the class.

The National Association of Social Workers recently published this warning:

Mental health leaders emphasized that progress is in jeopardy as social distancing rules and fears of the virus hamper traditional treatment efforts, including syringe exchange programs, peer counseling and medication-assisted treatment.

The U.S. wasn’t in a good place to begin with. A year before the pandemic began, the APA warned that the suicide rate in America is rising at “an alarming rate.”

Who profits from COVID-19 rumors and nonsense?

When I was still learning the skills of investigative reporting, my idol/colleague Steve Eckert would say, “Look for evidence of a motive. Usually the motive is money.” But sometimes the motive is to divert attention, grab power (closely associated with money) or to pose as the only answer to people’s problems.

My Poynter colleagues at the International Fact-Checking Network pointed out that where you find fake and frightening rumors about COVID-19, you will also likely find a motive behind them. For example, in Africa the rumors are linked to websites selling masks. In Brazil, COVID-19 rumors posted to social media are linked to a site selling “ozone generators.”

The COVID-19 shutdown’s effect on TV

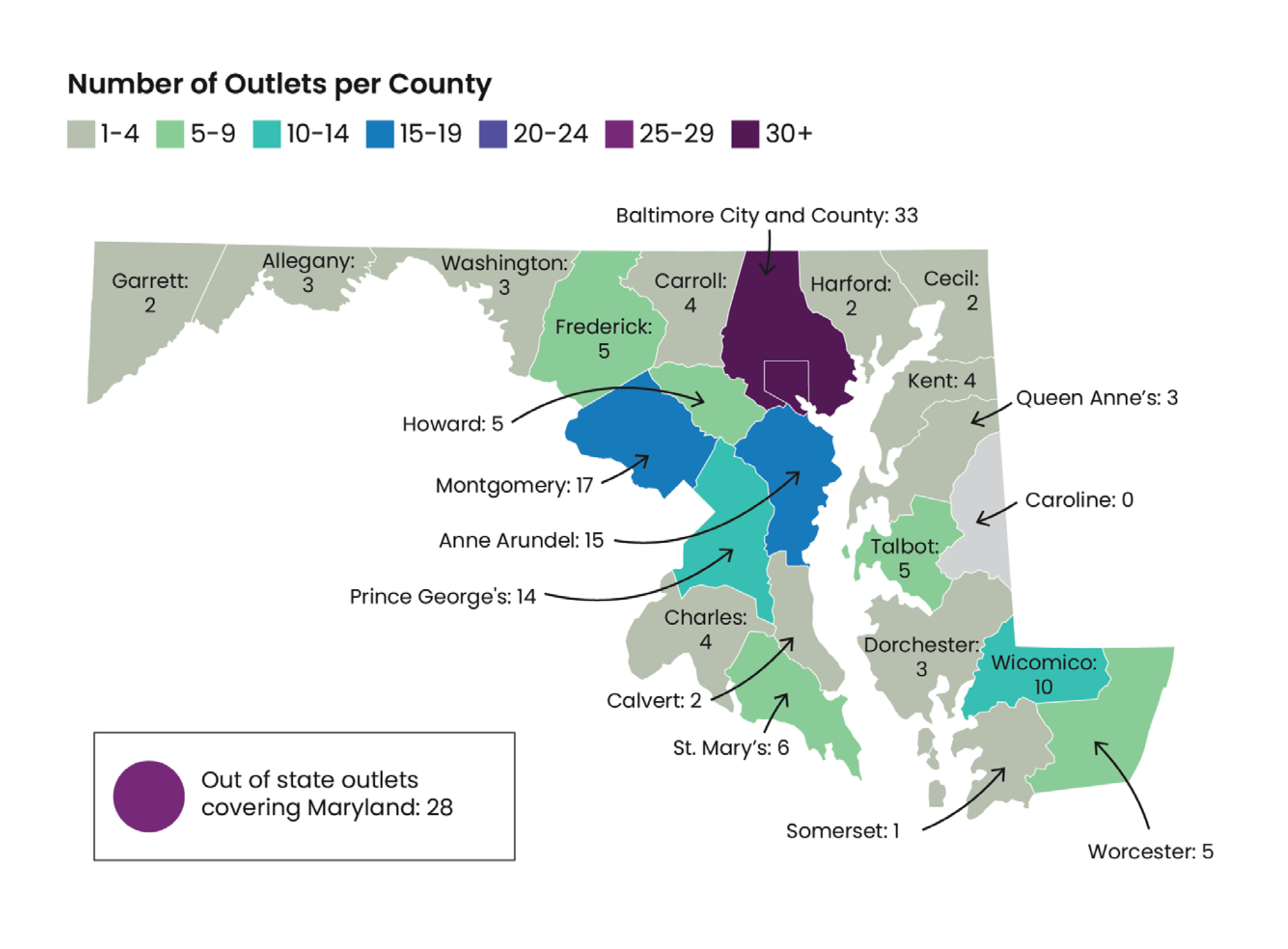

The owners of some of the country’s biggest TV stations reported first-quarter earnings and forecasts this week. Despite today’s unemployment figures, it is not all dismal.

Keep in mind as you look at these big increases in first-quarter income that the biggest players in local TV bought stations in the last year and political ads put money in the coffers in those places that had hot primary elections.

Tegna announced Thursday that the company’s revenue increased 32% in the first quarter of 2020. Tegna says acquisitions and political spending were big contributors to its growth. Take out the political spending and the growth drops to 24%. Tegna announced one-week furloughs for employees in the second quarter but told investors that it expects the business to begin rebounding in the third quarter, when political spending amps up.

Sinclair Broadcast Group said its revenue is more than double last year’s first quarter, up 134% year-to-year to $1.5 billion, versus $673 million in the first quarter of 2019. $40 million of that growth arrived via political advertising and through its acquisition of 21 regional sports networks and Fox College Sports in August. But the company warned that delays and potential losses of more sports events will be costly in the months ahead.

The company said it expects to see a 5% to 9% revenue drop in the second quarter compared to last year. But political advertising is still expected to rise in the second half of the year.

Nexstar Media Group Inc., the largest owner of TV stations in the country, also had a robust first quarter. The company said it has the resources to withstand the COVID-19 downturn. In its first-quarter report, the company said it saw a 177% increase in revenue from a year ago. First-quarter ad revenue was up a fairly amazing 87% in the first quarter, largely driven by political spending.

In a comment, Nexstar CEO Perry Sook said local TV is not just driven by advertising these days, but also gets money from cable companies, which pay for the right to carry the station’s signal.

“In 2020, over 50% of our annual revenue is expected to be derived from contractual distribution fee and political advertising revenue, which we do not expect to be materially impacted by coronavirus,” Sook said. “Notably, Nexstar has solid visibility in terms of our contractual distribution economics through December 2022 as we completed new multi-year retransmission consent agreements representing approximately 70% of our subscribers at year-end 2019, as well as new long-term network affiliation contracts with CBS, FOX and NBC.”

All the same, the stock market has taken a dim view of broadcasters in this pandemic year, even if it is an election year, too.

In January, Nexstar traded at $111 a share. It is now at $72. Sinclair hit its peak a year ago at $61.81 and now trades for $15.80 a share. Gray Television was $20 a share in February and is now at $12.76. TEGNA was at nearly $18 a share in January and about half that now.

We’ll be back Monday with a new edition of Covering COVID-19. Sign up here to get it delivered right to your inbox.

Al Tompkins is senior faculty at Poynter. He can be reached at atompkins@poynter.org or on Twitter, @atompkins.

A couple of things that are missed. First, you imply that fraud is minimal. I suppose if you believe that 1.3 billion in fraud is something to sneeze about, you need not go further. Second, finding a ‘way around’ using online purchases may not be what it’s cracked up to be. The use of EBT online is far to new to be signaling success. Only two major chains are allowed and once the retailers associating brings legal action for being shut out, watch how quickly the fraud flood gates open. Finally, a retailer can only ‘buy’ cards from those looking to ‘sell’ their benefits. At 1.3 billion in fraud, that’s more than just a ‘few people” selling their EBT benefits.